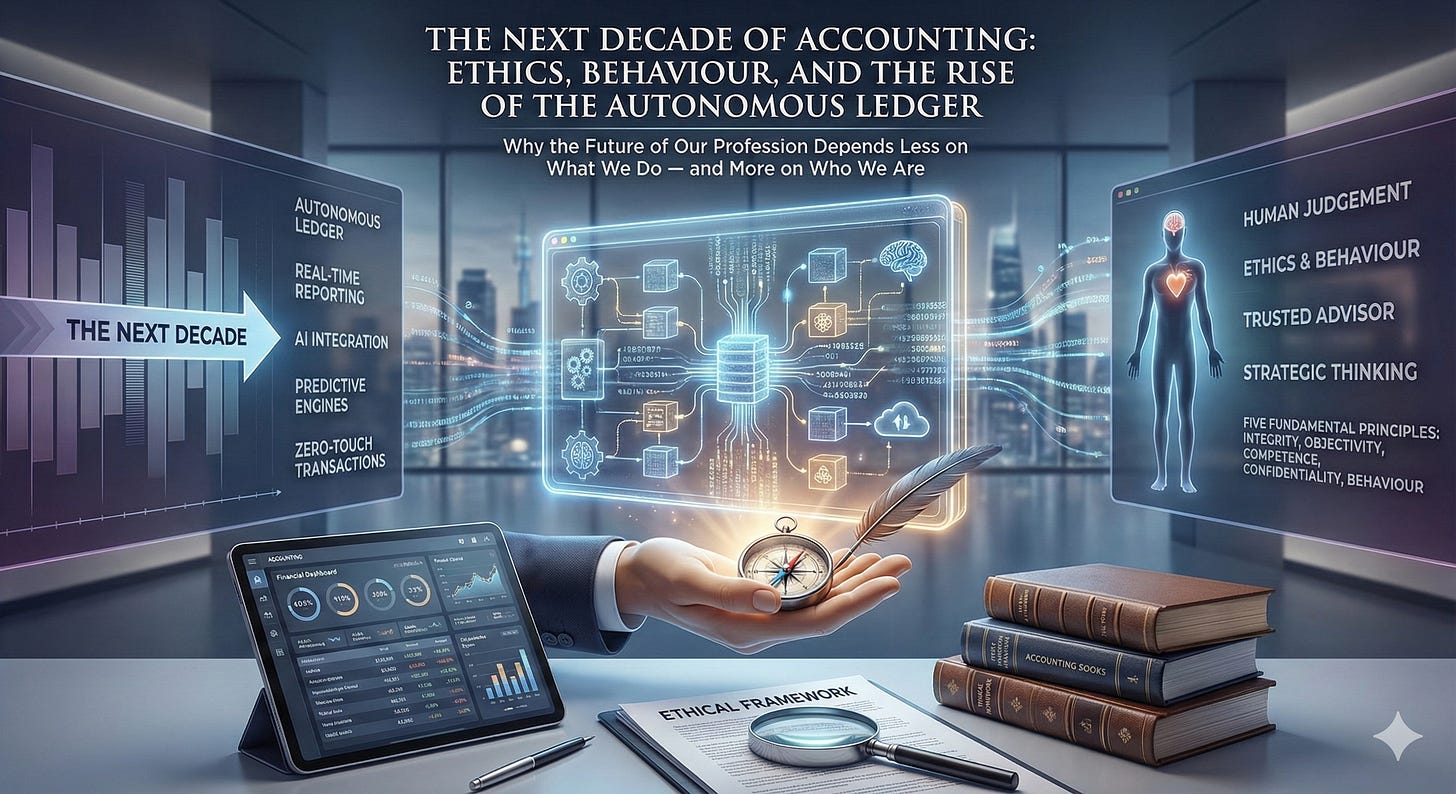

The Next Decade of Accounting: Ethics, Behaviour, and the Rise of the Autonomous Ledger

Why the Future of Our Profession Depends Less on What We Do — and More on Who We Are

The next decade will not simply change accounting.

It will expose it.

Artificial intelligence, integrated systems, predictive engines, automation, and real-time reporting are transforming the profession at a speed none of us have seen before. But the most profound shift will come from something deeper:

The emergence of the Autonomous Ledger.

A ledger that updates itself.

Corrects itself.

Learns from every interaction.

And maintains a continuous, single version of financial truth.

And here’s the paradox:

The more automated the work becomes, the more human the profession must become.

Because when the system handles the numbers, ethics and behaviour become the defining markers of relevance.

This is where the Five Fundamental Principles of the accounting profession do more than guide us — they become the competitive edge that separates trusted accountants from everyone else.

Let’s begin with clarity.

What Is the Autonomous Ledger?

The Autonomous Ledger is a financial system that:

captures transactions automatically

classifies them without human intervention

checks them for errors, duplicates, and anomalies

reconciles continuously — not once a month

predicts future movements based on patterns

alerts you to risks before they materialise

learns, improves, and adapts over time

Unlike today’s accounting software — which waits for humans to input, review, and correct — the Autonomous Ledger works proactively and independently.

It becomes the always-on, always-correct backbone of business finance.

And that changes our profession fundamentally.

Tasks disappear.

Excuses disappear.

Gaps disappear.

What remains is the accountant’s judgement, ethics, behaviour, and leadership.

And this is exactly where the Five Fundamental Principles become vital.

1. Integrity: The Autonomous Ledger Removes the Grey Areas

When the ledger is autonomous, data can no longer be massaged, delayed, hidden, or conveniently “cleaned up later.”

Integrity — the requirement to be honest and straightforward — becomes non-negotiable.

In the autonomous era:

Real-time systems expose inconsistencies immediately

Reports cannot be shaped to “tell a nicer story”

The truth arrives faster than the narrative

The Autonomous Ledger rewards accountants who deal in truth.

It punishes those who rely on manipulation, delay, or avoidance.

In a self-correcting system, integrity is not just an ethical principle — it is a performance requirement.

2. Objectivity: Automation Removes Bias, but Not Human Temptation

The Autonomous Ledger eliminates arithmetic bias.

But human bias still exists.

Clients will ask for shortcuts.

Leaders will sometimes push for favourable interpretations.

Teams will want to avoid friction.

Objectivity — the duty to avoid conflict, bias, and undue influence — becomes more important because:

Judgement replaces tasks

Interpretation replaces processing

Decisions carry more weight because the data is irrefutable

AI shows what is.

Objectivity helps us determine what should be done.

The accountants who thrive will be those who cannot be swayed by pressure, convenience, or relationship dynamics.

3. Professional Competence & Due Care: The Skill Shift of the Decade

When machines handle the mechanics, competence changes meaning.

It no longer means:

“Can you prepare accounts?”

The Autonomous Ledger does that.

It means:

“Can you interpret, advise, evaluate, and anticipate?”

“Do you understand the safeguards, risks, and implications of automation?”

“Can you use this system to improve client outcomes?”

Competence becomes:

judgement

strategic thinking

scenario planning

risk awareness

ethical reasoning

and the ability to navigate complexity

CPD becomes not just a regulatory requirement but a survival strategy.

4. Confidentiality: Real-Time Data Means Real-Time Responsibility

In the autonomous world, financial data moves quickly, integrates widely, and becomes more exposed to risk.

Confidentiality becomes a leadership behaviour, not a compliance item.

You must:

keep client data secure

prevent misuse of financial insights

avoid casual sharing

honour the boundary between access and advantage

Automation increases visibility.

Visibility increases risk.

This makes confidentiality more important, not less.

5. Professional Behaviour: The Autonomous Ledger Makes Behaviour Transparent

This principle — comply with laws and avoid actions that discredit the profession — becomes the ultimate differentiator.

Why?

Because behaviour is now visible inside autonomous systems.

Late responses.

Avoided conversations.

Poor judgement.

Unethical advice.

Weak follow-through.

Culture gaps inside firms.

When the numbers are perfect and automated, our behaviour becomes the only thing left to judge.

And clients will judge it.

Regulators will judge it.

Your team will judge it.

The market will judge it.

The Autonomous Ledger doesn’t just reveal financial truth.

It reveals professional truth.

The Conceptual Framework: Threats and Safeguards Still Matter — More Than Ever

Ethics is not just about principles.

It is about pressure.

The Conceptual Framework (Identify → Evaluate → Safeguard) becomes even more relevant because autonomous systems create new threats:

Self-interest threats

Firms may be tempted to rely too heavily on automation to cut corners or reduce review time.

Self-review threats

AI may produce outputs based on earlier inputs or models you designed — blurring accountability.

Advocacy threats

You may be asked to defend outcomes generated by systems the client doesn’t fully understand.

Familiarity threats

Automation often creates closer, more constant client interaction — which can soften objectivity.

Intimidation threats

Speed and transparency can intensify client pressure:

“Why didn’t you tell me sooner?”

“Why didn’t you act on this?”

“Why didn’t you stop me?”

Safeguards — such as independent reviews, ethical escalation processes, conflict disclosures, and strong internal culture — become crucial.

Automation doesn’t reduce ethical risk.

It changes its shape.

And our behaviour determines whether those risks are managed or magnified.

The Autonomous Ledger Is Not the End of Accounting — It Is the Beginning of Our Human Era

Technology has finally removed the noise:

No delays

No excuses

No manual errors

No “we’ll catch it next month”

No hiding weak behaviour behind workload

What’s left is the human layer:

judgement

ethics

communication

courage

responsibility

leadership

This is the accountant’s new job description.

Automation handles the numbers.

We handle the meaning.

Automation produces the facts.

We provide the wisdom.

Automation builds the ledger.

We build the trust.

The next decade of accounting will belong to firms that behave well — consistently, transparently, and courageously.

The Autonomous Ledger won’t make accountants irrelevant.

It will make bad behaviour irrelevant.

And it will elevate the accountants who lead with integrity, objectivity, competence, confidentiality, and professional behaviour.

Ethics is the foundation.

Behaviour is the signal.

Judgement is the value.

Relevance is the reward.

I’d really love to hear your thoughts on this.

Do you believe the Autonomous Ledger will strengthen the profession by exposing behaviour — or challenge us in ways we’re not yet prepared for?

Your perspective matters, because this shift affects all of us.